Direct Investing

CI Direct Investing offers direct online access to professionally managed portfolios utilizing low-cost Exchange Traded Funds, also known as ETF’s.

By utilizing Exchange Traded Funds (ETF’s) in your investment portfolios you may pay less in management fees than comparable mutual funds. When you pay less you get to earn more for yourself. It’s your money, you worked hard for it, now put more of it to work for you.

ETF Portfolios provided through CI Direct Investing provides professional diversification to help protect you from the ups and downs of the market.

Ultimately providing you the formula for potentially favourable returns.

Adding to this formula, you will have access to professional financial planning offered through Sageview Strategies Inc., now that’s an all-encompassing financial strategy that works for you.

Flexibility and Choice – with three broadly diversified portfolio options:

1. Essential Portfolios

ETF portfolios passively managed by Vanguard Investments Canada Inc. Low-cost diversification with underlying exchange-traded funds that provide exposure to broad-based equity and fixed-income markets. Capitalize on the use of a Vanguard’s passive investment strategy. The Essential Portfolios are low in fees and high on confidence.

2. ESG Portfolios

CI Direct Investing provides diversified one-stop portfolios with a focus on sustainable investing principles. Align your investments with your values. Do good and drive change. With the ESG Portfolios you don’t have to compromise on your investment goals. Make an impact by choosing low-fee, globally diversified portfolios built with funds selected for their performance track record—and the initiatives they support.

3. Private Investment Portfolios

Not all investments are created equal. CI Direct Investing has access to Nicola Wealth funds and is the only robo-advisor in Canada to offer exclusive access to these investments. Previously only available to high-net-worth clients, these high-calibre portfolios feature private asset classes for an even more balanced approach. These portfolios are built on a foundation of private assets complemented by public investments to provide a diversified approach to investing. Extensive diversification, access to investments not usually available to retail investors and cost-effective exposure to private assets. The Private Investment Portfolios focus on income-generating investments, such as real estate and mortgages, with the goal of reducing volatility and improving risk-adjusted returns over time.

Professional Advice. Low fees. Enhanced potential. Smart Technology.

Investing with confidence doesn’t need to be complicated.

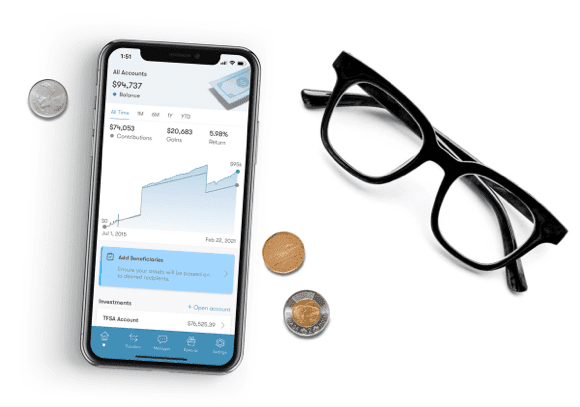

CI Direct Investing’s automated investment and savings app makes it easy to get personal financial advice, build better savings habits, and check on your progress—right from your phone.

Smart Technology and Professional Advice

Contact us to discuss how CI Direct Investing can benefit you.